Mortgage Broker - Questions

Wiki Article

The Broker Mortgage Rates Statements

Table of Contents3 Easy Facts About Mortgage Broker Average Salary DescribedHow Mortgage Broker Meaning can Save You Time, Stress, and Money.Everything about Mortgage Broker AssociationThe 2-Minute Rule for Mortgage Broker SalaryAll about Mortgage Broker Assistant Job DescriptionMortgage Broker Average Salary Things To Know Before You BuyThe smart Trick of Mortgage Broker Vs Loan Officer That Nobody is DiscussingHow Broker Mortgage Near Me can Save You Time, Stress, and Money.

A broker can compare financings from a bank and a credit rating union. According to , her initial responsibility is to the establishment, to make certain loans are appropriately safeguarded and the borrower is entirely certified and also will certainly make the financing payments.Broker Commission A mortgage broker stands for the debtor extra than the lending institution. His obligation is to get the customer the very best bargain possible, no matter the institution. He is usually paid by the finance, a kind of commission, the difference in between the price he obtains from the loaning institution and the rate he offers to the customer.

What Does Mortgage Brokerage Mean?

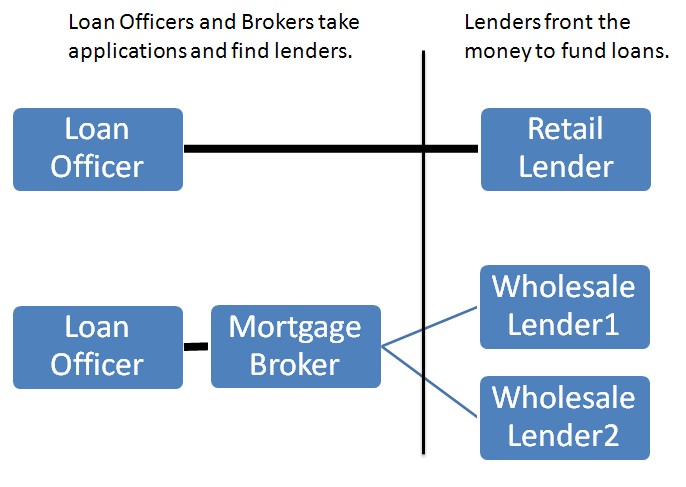

Jobs Defined Recognizing the benefits and drawbacks of each could assist you determine which profession course you wish to take. According to, the major difference between both is that the financial institution mortgage policeman represents the items that the financial institution they benefit offers, while a home mortgage broker deals with several lenders as well as works as an intermediary in between the lenders as well as client.On the various other hand, bank brokers might find the task ordinary after a while considering that the procedure commonly continues to be the same.

The 10-Second Trick For Broker Mortgage Near Me

What Is a Finance Officer? You might know that discovering a funding policeman is a vital action in the procedure of acquiring your car loan. Let's review what funding police officers do, what expertise they require to do their job well, and whether financing police officers are the most effective choice for customers in the car loan application screening procedure.

Broker Mortgage Rates - An Overview

What a Loan Police officer Does, A car loan police officer helps a bank or independent lender to help customers in using for a finance. Since lots of customers function with car loan policemans for home loans, they are frequently referred to as mortgage finance police officers, though many lending police officers assist customers with other loans.If a funding officer believes you're qualified, after that they'll advise you for approval, and also you'll be able to continue on in the procedure of acquiring your car loan. What Funding Police Officers Know, Loan police officers have to be able to work with customers and small company proprietors, and they need to have comprehensive knowledge regarding the industry.

Indicators on Broker Mortgage Calculator You Should Know

Exactly How Much a Funding Policeman Expenses, Some funding officers are paid via payments (mortgage broker assistant). Home loan fundings often tend to result in the largest commissions due to the fact that of the dimension and workload connected with the lending, but commissions are usually a flexible prepaid cost.Loan police officers recognize all next about the numerous kinds of fundings a lender might supply, and they can provide you guidance regarding the finest choice for you as well as your circumstance. Review your demands with your car loan officer.

Facts About Mortgage Broker Assistant Uncovered

2. The Function of a Funding Policeman in the Screening Refine, Your lending police officer is your straight contact when you're applying for a lending. They will research as well as review your economic history and also assess whether you receive a home loan. You will not need to bother with routinely contacting all the individuals included in the home loan process, such as the underwriter, genuine estate representative, settlement lawyer and you could try this out others, because your financing police officer will certainly be the factor of get in touch with for all of the entailed parties.Due to the fact that the procedure of a lending transaction can be a facility and also expensive one, several consumers prefer to deal with a human being as opposed to a computer. This is why banks might have several branches they want to serve the prospective customers in various areas that desire to fulfill in person with a lending officer.

A Biased View of Broker Mortgage Calculator

The Function of a Funding Policeman in the Lending Application Process, The home mortgage application process can really feel overwhelming, specifically for the new property buyer. Yet when you deal with the best funding policeman, the procedure is really quite simple. When it pertains to applying for a home mortgage, the procedure can be damaged down into 6 stages: Pre-approval: This is the phase in which you discover a loan officer and get pre-approved.During the funding processing phase, your lending officer will certainly contact you with any kind of concerns the finance processors might have about your application. Your finance officer will certainly after that pass the application on the expert, who will certainly examine your credit reliability. If the expert accepts your financing, your loan police officer will certainly then collect as well as prepare the proper finance shutting papers.

Unknown Facts About Mortgage Broker Average Salary

So how do you select the appropriate lending police officer for you? To begin your search, start with lending find out here institutions that have an excellent track record for surpassing their consumers' assumptions and maintaining industry criteria. As soon as you have actually picked a lender, you can after that begin to narrow down your search by interviewing funding police officers you might wish to collaborate with (broker mortgage near me).

Report this wiki page